Join more than 40,000 people using the EasyFX card

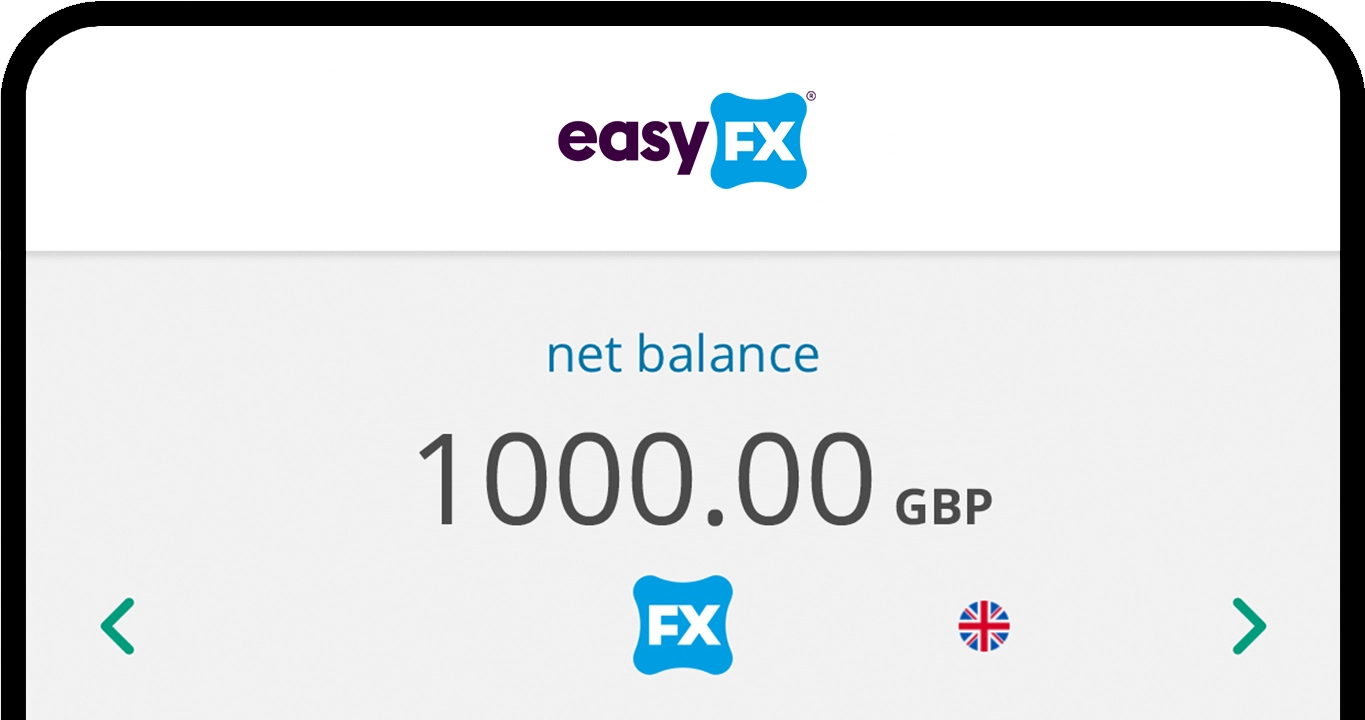

Manage your spending via the app

Travel money in the palm of your hand. Manage your balance and view transactions on the go from any device. Also, top up your card with multiple currencies.

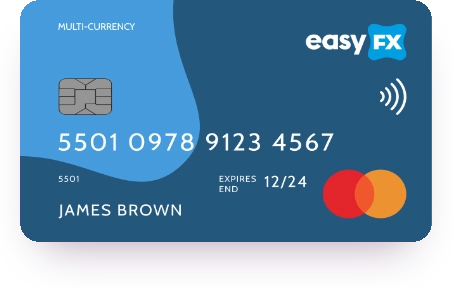

35 million locations worldwide

Your EasyFX card can be used wherever Mastercard is accepted. That's over 35 million locations worldwide, over 2 million ATMs and most online merchants.

Low fees

With EasyFX you'll bring home souvenirs, not bank charges. Enjoy free purchases, free ATM withdrawals and free international transfers, wherever you go.

The EasyFX app

Your travel money card companion.

The EasyFX app

Your travel money card companion.

Purchase currency

Buy currency at competitive rates and store it on your card.

Manage currency

Manage multiple currencies quickly and easily on the app.

Make transfers

Make international transfers with none of the usual fees or charges.

View transactions

Use the app to view transactions and manage your money easily.

Top up travel money cards

Top up your travel money card in moments with a simple bank transfer.

Your money, safe and secure

Regulated by the Financial Conduct Authority.

The same secure technologies are used by major credit card providers for total peace of mind.

No frantic phone calls home. Block your card with the touch of a button if it gets lost or stolen.

Use the travel money card with multiple currencies…

Forget grappling with notes and coins. Store several different currencies on your card at the same time, including these...

AUD

CAD

CHF

DKK

EUR

HKD

JPY

NOK

NZD

PLN

SEK

USD

ZAR

The EasyFX Travel Money Card is currently not available for new customers.

EasyFX card fees

First card order minimum load

£50

Purchase transactions

Free

ATM cash withdrawals

Free

Annual management

Free

FAQ

Your EasyFX card can be used for the following transaction types:

Chip and Pin - Insert the card into the reader and then enter your 4 digit pin number when prompted;

Online - Purchases made through the internet;

Mag Stripe - When your card is swiped through the card reader or the 16 digit card number is entered manually;

Contactless - If your card has the symbol on it, you can pay for items by simply holding your card up to any reader with this symbol displayed.

Your card does not support signature verification.

Note: Your first card transaction must be performed using a chip and pin terminal.

You have complete control over how you use your card, thanks to the card settings. You will find these with your card details under "cards", on the web app and "Cards", "Currency Cards" on the mobile app. Chip and Pin is always available, but other settings are configurable as follows:

Contactless - This setting is enabled by default and can be disabled from the card security settings at any time. You will be prompted by the Point-of-Sale machine to use chip and pin with contactless enabled under the following circumstances:

- After 5 contactless transactions or after spending €150* (or equivalent in other currencies)

- For any transaction of greater than €50* (or equivalent in other currencies)

This action will reset the contactless counter so you may continue to make contactless transactions.

*Value is subject to change

Mag Stripe - This setting is off by default and can be enabled through the card settings. Choose the country you wish to transact in and enter an end date (up to a maximum of two weeks). When the end date is reached the setting will automatically turn off but can be enabled again by following the same steps as before. To minimise risk, only one country can be enabled at a time;

Online - This mode is ON by default. Online payments are protected by 3D Secure authentication.

We recommend only enabling these card settings when needed, to minimise any risk to your card becoming compromised.